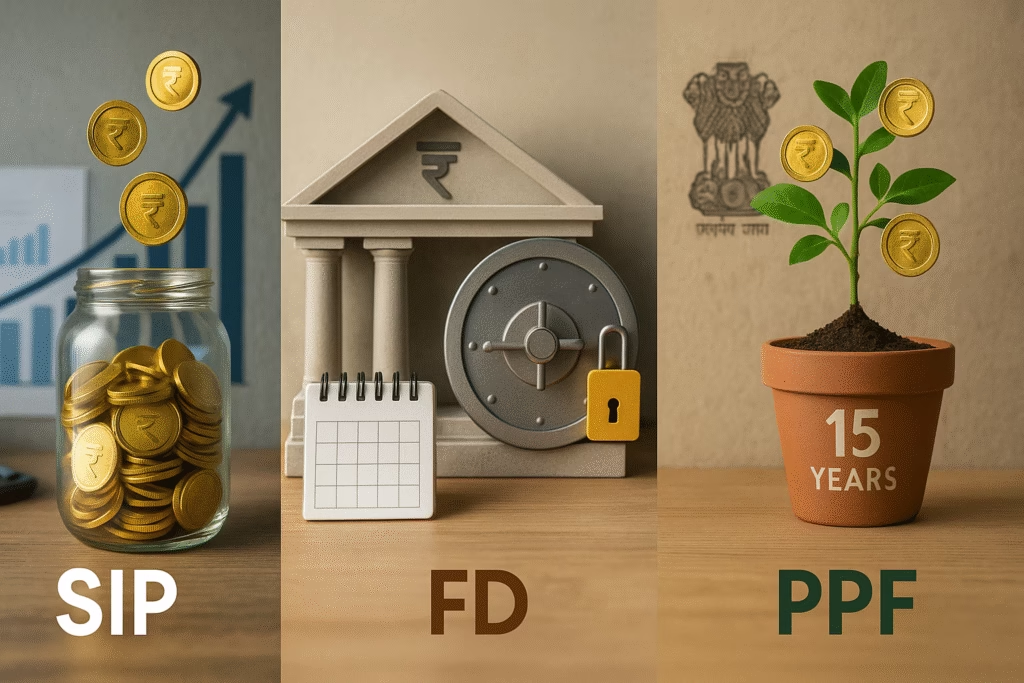

When it comes to saving and growing your money, three popular choices often come up in India — SIP (Systematic Investment Plan), FD (Fixed Deposit), and PPF (Public Provident Fund). Each of these options has its own advantages and disadvantages. But which one is the best for you? The answer depends on your financial goals, risk appetite, and time horizon.

1. What is a SIP (Systematic Investment Plan)?

A SIP is a way to invest in mutual funds. Instead of putting a large amount at once, SIP allows you to invest a fixed amount regularly, like ₹500 or ₹1,000 every month. This makes it easy for salaried people and young investors.

Benefits of SIP:

-

Disciplined saving: You invest every month without fail.

-

Power of compounding: Your money grows over time with reinvestment.

-

Rupee cost averaging: You buy more units when the market is low and fewer when it is high, reducing overall risk.

-

High returns (potential): SIPs, especially in equity funds, can give better returns over the long term.

Drawbacks of SIP:

-

Market risk: Since it is linked to the stock market, returns are not fixed.

-

Requires patience: You need to invest for at least 3–5 years to see good results.

2. What is FD (Fixed Deposit)?

A Fixed Deposit is a safe investment option offered by banks and post offices. You deposit a lump sum of money for a fixed period (like 1 year or 5 years), and you earn interest on it.

Benefits of FD:

-

Guaranteed returns: Your money is safe, and returns are fixed.

-

Easy to open: You can open an FD online or at any bank branch.

-

Flexible tenure: You can choose the period of your FD as per your needs.

-

Low risk: Ideal for risk-averse people like retirees.

Drawbacks of FD:

-

Low returns: Most banks offer 5% to 7% interest, which may not beat inflation.

-

Taxable interest: The interest you earn is fully taxable.

-

Lack of flexibility: Breaking an FD early can result in a penalty.

3. What is PPF (Public Provident Fund)?

PPF is a long-term savings scheme backed by the Government of India. It is a great option for building a retirement corpus and offers tax-free returns.

Benefits of PPF:

-

Safe and secure: Since it’s government-backed, there’s no risk.

-

Tax benefits: You get tax deductions under Section 80C, and the interest is tax-free.

-

Decent interest rate: The current PPF rate is around 7.1% (subject to change every quarter).

-

Long-term growth: Ideal for long-term goals like retirement or children’s education.

Drawbacks of PPF:

-

Lock-in period: Money is locked for 15 years.

-

Limited investment: Maximum investment is ₹1.5 lakh per year.

-

Low liquidity: Partial withdrawals are allowed only after the 6th year.

4. SIP vs. FD vs. PPF – Quick Comparison Table

| Feature | SIP | FD | PPF |

|---|---|---|---|

| Risk | Medium to High | Very Low | None |

| Returns | 10-15% (not fixed) | 5-7% (fixed) | ~7.1% (fixed) |

| Lock-in Period | No lock-in (except ELSS SIP) | Chosen by you | 15 years |

| Tax Benefits | Only ELSS SIP (80C) | No (except 5-year FD) | Full 80C + tax-free |

| Liquidity | High | Medium | Low |

| Best For | Long-term growth | Short-term safety | Retirement savings |

5. Which Investment Is Best for You?

The best investment depends on your goals, age, income, and comfort with risk.

Choose SIP if:

-

You are young and want to grow wealth over the long term.

-

You are comfortable with short-term ups and downs.

-

You want to invest regularly with small amounts.

Choose FD if:

-

You want safety for your money.

-

You have short-term goals like buying a phone or going on a vacation.

-

You are a senior citizen who prefers steady returns.

Choose PPF if:

-

You want to build a retirement fund.

-

You are looking for a tax-saving investment.

-

You don’t need liquidity and can stay invested for 15 years.

6. Can You Invest in All Three?

Yes! In fact, a smart investment strategy is to diversify. You don’t need to choose only one. You can invest in:

-

SIP for long-term wealth growth,

-

FD for safety and short-term goals,

-

PPF for retirement and tax savings.

This way, you can enjoy the benefits of all three without putting all your money in one place.

7. Take This With You

When it comes to choosing between SIP, FD, and PPF, there is no one-size-fits-all answer. Each option has its own strengths and purpose. SIPs can give higher returns over the long run, FDs offer safety and fixed income, and PPF helps with retirement planning and tax savings.

Understand your needs, compare the features, and invest wisely.

For easier and helpful financial tips, follow Blogimine. We share smart money ideas to help you save, invest, and plan better. Whether you’re a beginner or looking to grow your wealth, Blogimine is your trusted source for simple and clear financial advice you can use every day.

Disclaimer:

This blog is for general information only and does not offer financial advice. Please consult a certified financial advisor before making any investment decisions. Blogimine is not responsible for any loss or risk from actions taken based on this content. Investment choices depend on personal goals, risk level, and financial condition.